Larry’s Story

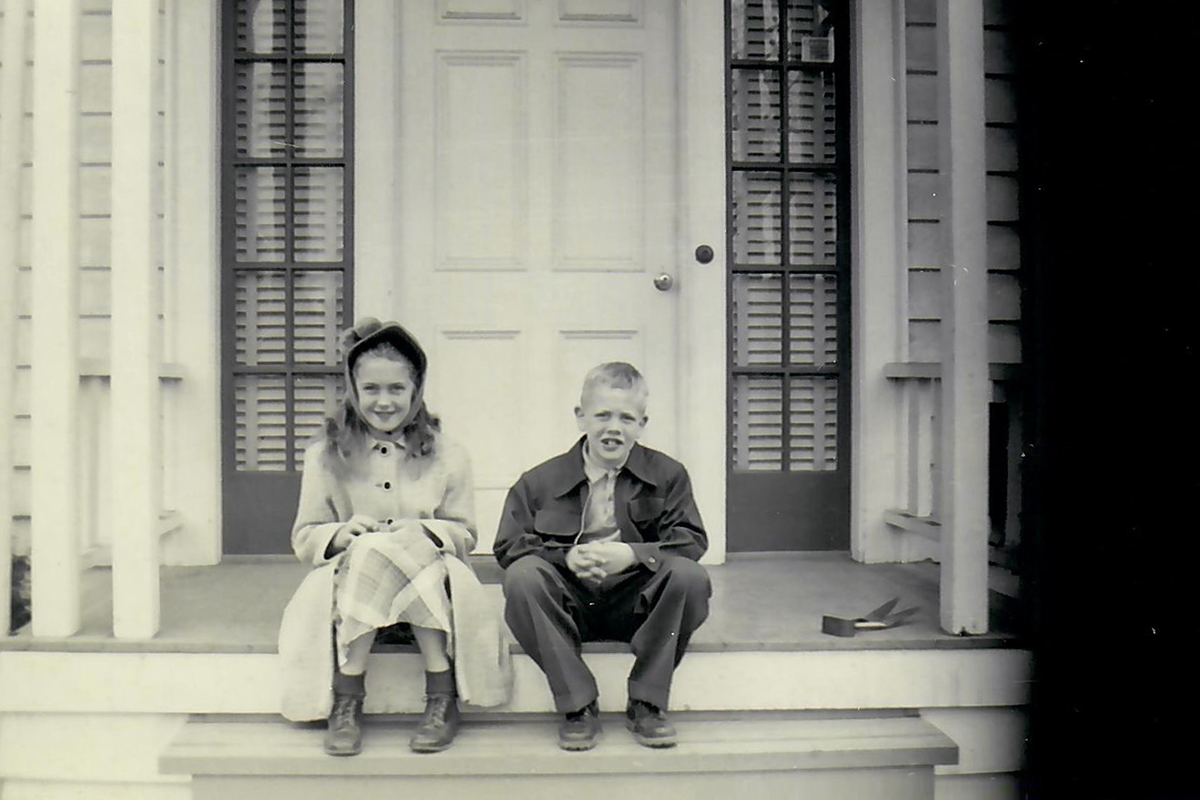

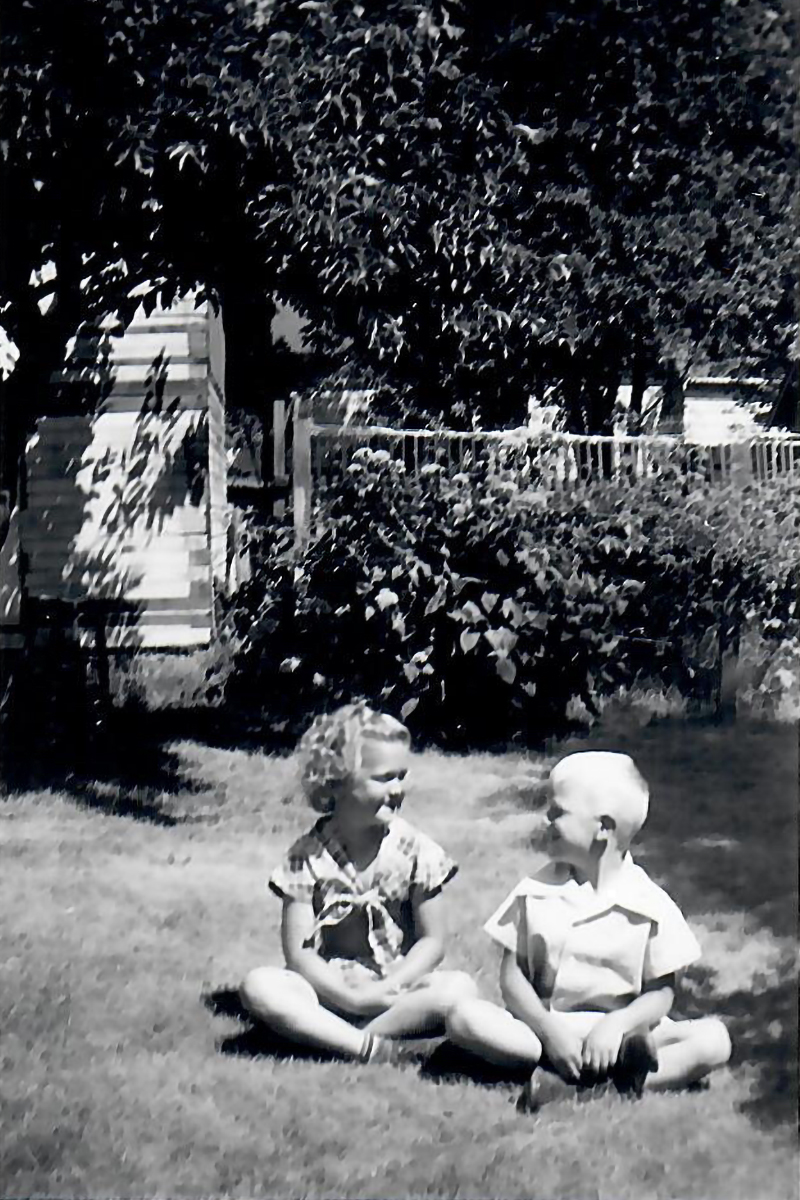

Larry Wilfred Cook was born August 30, 1945, to Phillip and Esther Cook in Seattle, Washington. While he was still a toddler, his parents divorced, and Esther, whom Larry affectionately called “Ma,” began working full-time for the telephone company in Seattle to support him and his older sister, Sharry Lou, whom he lovingly referred to as “Sis.” When Larry and Sharry were out of school for the summer, they resided with their grandparents on a small farm near the Skagit Valley of Western Washington. Life on the farm and Esther’s example instilled in Larry a strong work ethic and sense of frugality, which stayed with him his entire life.

Esther later remarried, and the family moved to a farming community, where Larry attended middle and high school. He developed an adventurous and inquisitive spirit and participated in the Cub Scouts and Boy Scouts, later becoming an Eagle Scout. Scouting established a strong foundation for his future military career. Larry also entered produce in both the Snohomish County Fair and the Evergreen State Fair, where he won numerous ribbons in gardening for his table carrots, green tomatoes, giant snap beans, cabbage, pole beans, and kohlrabi.

The family later moved back to Seattle, and Larry attended Roosevelt High School where he became a proud member of the Radio Electronics Club and competed on the Rough Riders’ swim team. In his senior year, Larry received an ROTC scholarship, and chose to stay close to home by enrolling at the University of Washington.

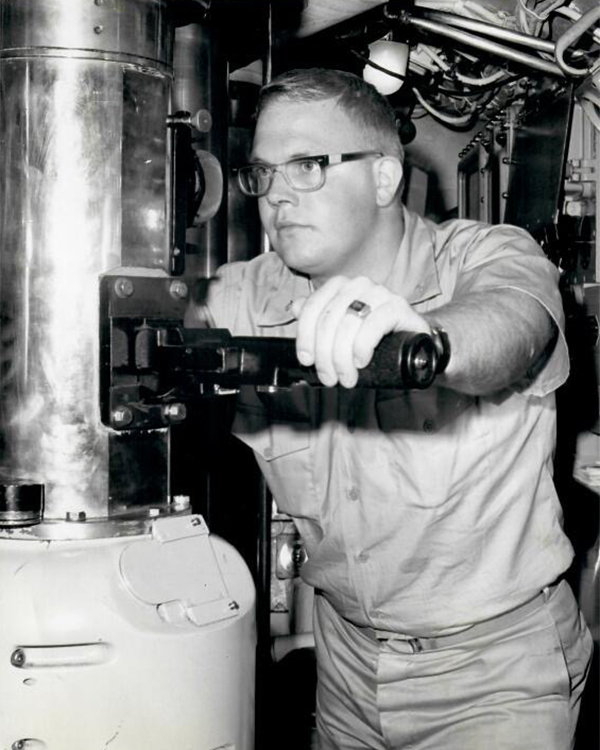

In 1968, Larry graduated UW with a bachelor’s degree in electrical engineering, then entered the Navy as Ensign officer. For the next 24 years, Larry served his country and traveled the world, working in several operational, supporting, and commanding positions on nuclear submarines after graduating from the U.S. Navy Nuclear Propulsion Program.

From 1968 to 1992, Larry conducted operational missions on various submarines. During his service, he conducted missions on five fast attack submarines and a ballistic missile submarine, overseeing the nuclear reactor and power plant maintenance, as well as ship control, support, hull, and combat weapon systems. He served five deployments to the western Pacific Ocean and one deployment to the Mediterranean and completed numerous classified missions, including seven highly classified special operations.

As his career advanced, Larry took on increasingly responsible roles, planning, and executing anti-submarine, anti-surface, and special warfare training missions during these deployments. From 1984 to 1988, Larry was the Commander of the USS Pargo (SSN-650), a Sturgeon-class attack submarine. During this time, he directed Navy undersea warfare test and evaluation for nuclear submarines. In July 1992, Larry retired from the Navy as a trusted Nuclear Submarine Commander, having dedicated 15 years, two months, and 11 days of his life in sea service (on active submarine deployment), comprising more than half of his 24-year military career.

Following his decorated military career, Larry continued his service by working in the private sector as a military consultant. He shared his subject matter expertise with clients at Booz Allen Hamilton and Zimmerman Associates and settled in Herndon, Virginia. During his nearly 20 years with Zimmerman Associates, Larry worked with the Submarine Programs Offices at The Naval Sea Systems Command. He also worked on the United Kingdom’s TRIDENT nuclear program. He eventually held the title of Vice President of Zimmerman Associates’ Engineering and Analysis Group, providing technical and managerial support to the United States Department of the Navy’s far-reaching contracts.

Duty was central to Larry’s life — not just duty to country but duty to family. He cared for his mother Esther until her death at the age of 101 in 2019. Later that same year, Larry suffered a stroke that left him neurologically impaired, which resulted in his inability to return to the military consulting work that fulfilled him.

On April 29, 2021, Larry passed away at his home.

In the months leading up to his death, Larry became the victim of elder financial exploitation. The impacts of his stroke left him vulnerable, and this vulnerability was exploited by a transnational organized crime and cybercrime scam. This scam robbed him of more than $3.6M of his hard-earned wealth through the disbursement of 74 international wire transfers.

Larry had been an account holder since 1971 with the credit union that disbursed these wire transfers. In his nearly 50 years of credit union membership, he diligently saved his earnings. However, from October 2020 to April 2021, a six-month period during COVID, Larry began sending multiple international wire transfers weekly, most of which were for $49,500 and were specified as loan repayments.

Despite intervention by Adult Protective Services, no attempt was made by the credit union to contact any family members, nor did they halt any of the wire transfers.

It is the Estate’s opinion that his failing health, coupled with the stress caused by this scam, ultimately led to his death.

Per his wishes on October 22, 2021, Larry was buried at sea, in a ceremony conducted by the United States Navy near Pearl Harbor, Hawaii. Following Navy tradition, the ship slowed and colors were displayed at half-mast, three volleys of rifle salutes were fired, and Larry was committed to a notably calm sea with full military honors.

Larry was an active member of the Navy League of the United States, a Life Member of the Institute of Electrical and Electronics Engineers, a Life Fellow of the Oceanographic Foundation, a Lifetime Member of the Military Officers Association of America, and a member of the International Test and Evaluation Association. His service and dedication lives on through his impactful contributions to both military and civilian sectors, his active involvement in professional and veterans’ organization, and his ongoing support for numerous charitable causes.

Throughout his lifetime and career, Larry’s hard work, financial discipline, and commitment to saving led to a sizable accumulation of wealth. Larry regularly donated to over 30 charitable causes, including Disabled American Veterans, Wounded Warrior Project, U.S. Navy Memorial Foundation, The National WWII Museum, Paralyzed Veterans of America, The ALS Association, Multiple Sclerosis Foundation, Alzheimer’s Association, The Red Cross, Habitat for Humanity, Easterseals, as well as additional military and veteran support organizations and disease foundations. Larry planned to use his wealth to set up a foundation to continue to support these charities in perpetuity.

His life was a testament to duty, to his country, his family, and his colleagues, leaving a lasting impression on all who knew him.

After his passing, Larry’s legacy of service lives on through his Estate’s collaboration with Virginia Delegate Michelle Maldonado and her team. In February 2024, the Virginia General Assembly passed House Bill 692, also known as “Larry’s Law,” with no dissenters.

The measure lays the groundwork for financial institutions to train their employees in how to identify potential financial exploitation of senior citizens and report suspected financial exploitation of a senior to the authorities. It also permits them to notify a trusted contact of such exploitation and directs the Bureau of Financial Institutions of the Virginia State Corporation Commission to establish training guidelines for detecting and preventing elder financial exploitation of vulnerable adults.

The growing prevalence of financial fraud, both international and domestic, underscores the urgent need for changes in laws and regulations to establish robust financial services protections to prevent exploitation.

These safeguards are essential for protecting both financial institutions and their customers from unusual and potentially fraudulent activities. For financial institutions, these protections help preserve trust, ensure regulatory compliance, and mitigate the risk of financial losses from fraudulent transactions. For customers, these measures secure their personal and financial information, provide peace of mind, and protect their assets from unauthorized access, withdrawals, distribution, and exploitation.

By implementing stringent AI protocols, continuous monitoring systems, and comprehensive training certifications and regulatory requirements, financial institutions can proactively detect and prevent fraudulent activities, thereby fostering a safer and more secure banking environment for all stakeholders.

The Estate will continue to advocate for significant legislative reforms throughout the United States to compel regulators and financial services to address the realities of elder financial exploitation, banking and wire fraud. The Estate asserts that laws must keep pace with the sophistication of national, international cyber criminals, and transnational cybercrime, emphasizing that we are all potential victims without updated regulations and laws.

Their proposed changes include:

1) Enactment of laws and regulations requiring mandatory utilization of AI-powered fraud detection and prevention software to analyze transaction data and detect anomalies to identify suspicious wire activity, prior to authorizing wire transfers. Any outgoing wire transfers, flagged by AI software as suspicious or fraudulent activity, would not be released by the financial institution unless the bank initiated a dual control override. Dual control override would require approval by two staff members to initiate, approve, and release any AI flagged wire transfers.

2) Establishing a certification program for all financial services employees involved in domestic and international money wiring.

3) Advocating for the enactment of protections for banks, credit unions, and financial services institutions to not move money when unusual or potentially fraudulent wire activity is detected to protect the account holder. Additionally, proposing changes to the law (U.C.C. Article 4A) to shield these banks, credit unions, and financial services institutions from lawsuits when withholding funds under these circumstances will further enhance the security and integrity of wire transactions.

4) Allocating funds from banks to support Adult Protective Services, as they are underfunded despite being more effective in combating exploitation. Funds should be allocated from banks, credit unions, and financial services to support Adult Protective Services (APS) in the handling of all cases related to wire fraud and financial exploitation.

5) Ensuring financial and legal accountability of financial services, banking and credit union institutions for wire fraud, akin to measures in place for credit/debit card fraud.

6) Federal enactment of Virginia Delegate Michelle Maldonado’s H.B. 692, “Larry’s Law”, which is designed to create uniform training guidelines for spotting and reporting financial abuse and exploitation, while giving banks broader legal protection should they be accused of sharing private information in the pursuit of protecting a customer. This measure encourages banks to not just contact a trusted person listed on a customer’s account if they suspect financial exploitation, but also to potentially reach out to another relative with their concerns if all else fails. In exchange, banks and credit unions that undergo this training won't be held civilly liable for disclosing their concerns to the proper people and authorities.

When APS identifies an instance of adult financial exploitation and notifies the bank, credit union, or financial services institution, they are required to stop the movement of all funds. Banks, credit unions, and financial services that authorize movement of funds or wire transfers following an alert by APS will be held responsible for any resulting financial losses. This would require new legislation to protect both the APS, banks, credit unions, and financial institutions from risk. To effectively fulfill this critical role, APS must receive additional funding and resources.

Elizabeth Warren once said that banking should be boring, a sentiment that underscores the necessity for financial institutions to prioritize the security of their citizens over risky ventures. Larry’s lifelong commitment to protect and serve is a call to action, urging us to bring about significant changes in financial regulations, anti-money laundering laws, laws governing financial wire transfers, and the much-needed amendments to U.C.C. Article 4A. Just as the Patriot Act mandates a high level of commitment to national security, banks should exhibit the same unwavering dedication to their customers’ financial safety, just as Larry served his country. By heeding this call, we can ensure that banks, credit unions, and financial services institutions fulfill their fundamental duty of protecting all clients from fraudulent activity, securing a safer financial future for all.